Investment Stewards Since 1981

Capital Investment Services of America, Inc. is an employee-owned Milwaukee-based investment advisor that serves high-net-worth individuals, trusts, businesses, and charitable organizations. We build custom-tailored investment portfolios to achieve our client’s individual financial objectives.

Our firm is a registered investment advisor with the SEC.

A History of Wealth Stewardship

Since our founding in 1981, our mission—our very purpose for existing—has been the responsible stewardship of clients’ assets.

Stewardship may sound old-fashioned, but we believe that doing what’s right for our clients—particularly when it’s not the easy or a popular thing to do—never goes out of style.

"Investment management used to be a profession focused on stewardship. It has become a business focused on salesmanship."

Seat at the Table and Skin in the Game…

When Capital’s investment team meets, clients always have a seat at the table, for we, too, are clients of our firm. Most of us have our investment wealth—and that of our families—invested in the same stocks and bonds as all our clients.

‘Eating our own investment cooking,’ or what’s commonly called ‘having significant skin in the game,’ aligns our interests with those of our clients.

Skin in the Game…and Soul in the Profession

Our commitment doesn’t end with ‘skin in the game.’ Each of us at our firm has ‘soul in the profession’ as well. Our purpose—our mission and meaning as a firm—is wrapped up in what we do.

On the website pages that follow, we provide some specifics that detail how we go about our mission.

Seat at the Table and Skin in the Game…

When Capital’s investment team meets, clients always have a seat at the table—for we, too, are clients of our firm. Most all of us have our investment wealth—and that of our families—invested in the same stocks and bonds as all our clients.

‘Eating our own investment cooking’ or what’s commonly called ‘having significant skin in the game,’ aligns our interests with those of our clients.

Skin in the Game…and Soul in the Profession

Our commitment doesn’t end with ‘skin in the game’. Each of us at our firm has ‘soul in the profession’ as well. By this we mean our purpose—our mission and meaning as a firm—are wrapped up in what we do.

On the website pages that follow, we provide some specifics on how we go about our mission.

Balanced Investment Strategies, Backed by Experience

Our Process

Our Team

To meet the responsibility of caring for your resources, we have assembled a team of experienced investment professionals.

Get Started

Working with an investment partner should create peace of mind. We make it easy, providing any education you need.

Investment Insights

Work Clothes…and the Space In-Between?

Happy New Year! Ring-out the old, ring-in the new.

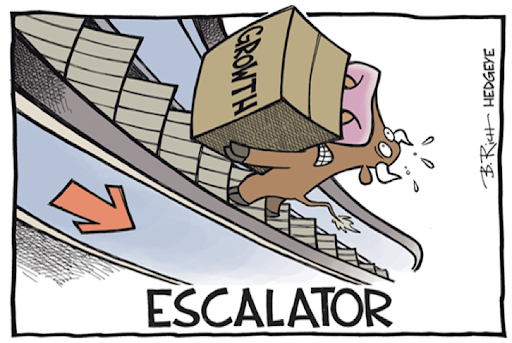

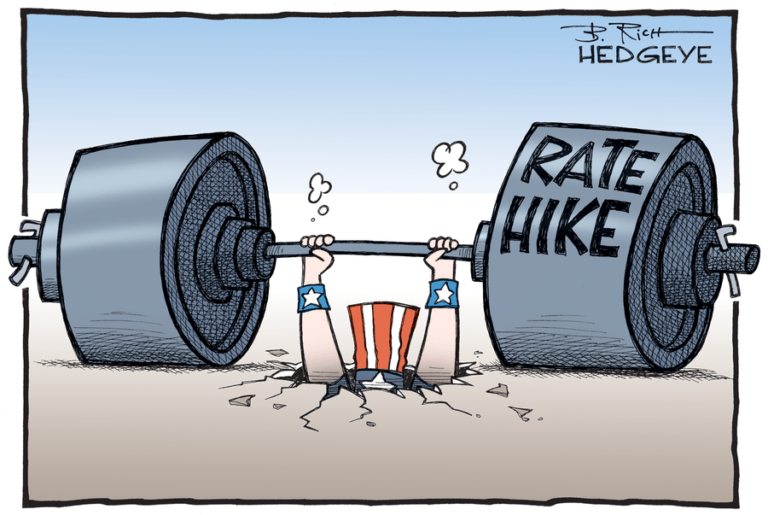

Captain Macro at the Helm

“In a normal functioning market (company specific), fundamentals play a large role in the direction of individual stock prices.

Can’t “Be Like Mike”, But…

Nike’s Air Jordan shoes, Hanes undershirts and Gatorade’s “Be Like Mike” campaign have been bigtime advertising successes for Jordan and the companies involved.

Work Clothes…and the Space In-Between?

Happy New Year! Ring-out the old, ring-in the new.

Captain Macro at the Helm

“In a normal functioning market (company specific), fundamentals play a large role in the direction of individual stock prices.

Put Your Trust Where It Counts

Stay connected with Capital Investment Services to receive vital insights into our investment strategies and market developments.

"*" indicates required fields