Sports talk shows fill hours of airtime with debates about which player in a sport is the “GOAT”—as in Greatest Of All Time. The debates engage and enrage audiences in large part because it is very difficult to compare players across different eras.

Michael Jordan may not be everyone’s choice as the greatest basketball player, but it’s hard to argue that he isn’t the GOAT of sports-personality advertising. Nike’s Air Jordan shoes, Hanes undershirts and Gatorade’s “Be Like Mike” campaign have been bigtime advertising successes for Jordan and the companies involved.

In the investment world, there’s not much debate that Warren Buffett and Charlie Munger of Berkshire Hathaway are the GOAT investors.

In this period of economic and financial market mayhem we thought a review of some wisdom from the GOAT investors might be helpful.

Let’s lay the groundwork with a few Buffett quotes:

- “Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold.”

- “The stock market is a wonderfully efficient mechanism for transferring money from the impatient to the patient.”

- “Though markets are generally rational, they occasionally do crazy things. Seizing the opportunities then offered does not require great intelligence, a degree in economics, or a familiarity with Wall Street jargon such as alpha and beta. What investors need instead is an ability to both disregard mob fears or enthusiasms, and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period – or even to look foolish – is also essential.”

- “Only when the tide goes out do you discover who’s been swimming naked.”

Consuming Gatorade won’t make someone “Be Like Mike” on the basketball court. But being like the GOATs investors and focusing on key fundamentals can significantly increase the probability of investment success over time.

Buffett/Munger attributes

We think critical ingredients to Buffett and Munger’s investment success are the following:

- Do not underestimate the dynamism underlying the U.S economy.

- Maintain a dispassionate mindset towards markets.

- Maintain a longer-term perspective.

- Focus on business fundamentals for they will increase the odds of identifying exceptional businesses for investment.

Let’s examine these in a bit more detail and offer context within the current investment environment.

Don’t underestimate the dynamism underlying the U.S. economy

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold.”

Warren Buffett

The dark clouds currently filling the skies are widely recognized: high inflation, “tightening” of monetary policy by the Federal Reserve (The Fed) (and most of their global counterparts), supply chain messes triggered by COVID-19 lockdowns, the rising probability of recessions around the world, and dictator Putin’s tragic war on Ukraine.

The current dark clouds provoked traders to dump both bonds and stocks during the first half of 2022.

As a result, the U.S. bond market suffered one of its worst periods ever with double digit declines in bond prices common. (By the way, the rise in yields has significantly improved the risk/reward profile of the short-term bonds we favor).

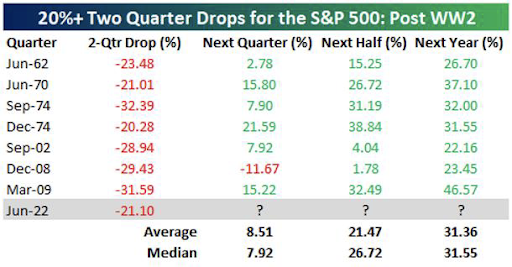

And, as the following table (compiled by the research firm Bespoke) reflects, during the first half of this year stocks joined the list of most difficult six-month stretches in modern times.

As intractable as today’s problems appear, it is also important to consider that big troubles also surrounded each of the other 7 episodes of investment duress identified in Bespoke’s table.

For example, the earlier dark cloud periods included:

- Two of the worst recessions since the Great Depression—1974 and the Financial Panic and of 2008-09.

- We also must note that in 2008-09’s mayhem the U.S. financial system came way too close to a Great Depression-like collapse. (A very scary investing time!)

- The recession following the 9/11/01 terrorist attack and the “dot-com” stock meltdown.

- Rising inflation along with the escalation of the Vietnam War, and a lack of confidence in both the economy and U.S. government amidst elevated stock valuations of the 1960s-70s.

We can attest to the intensity of investor FUD (Fear, Uncertainty and Doubt) as well as the pervasive pessimism that “there is no way out of this mess” during the three more recent episodes listed in Bespoke’s table.

And yet, “things” did get better and stock prices did soon recover. In each of the 7 previous periods that Bespoke identifies in its table, the stock market was higher by an average of 20+% in the next six months and 30%+ over the subsequent year.

It’s also interesting to note that in 1970 when the stock market suffered through a first half of the year decline like that experienced here in 2022, the market registered a gain for the year. Playing an important role in the recoveries was the underlying dynamism of the U.S. economy.

Buffett and Munger refer to dynamism as the “American miracle”, and the “American magic”.1 We have often discussed it as the creative-disruption process.

The private sector of the U.S. economy is constantly building itself back better as innovative new products, services, and improved ways of doing things (while disrupting the status quo).

Dynamism is one of the most under-appreciated aspects of our economy.

Somewhat ironically, a few years back, Munger told a group “all the reasons Tesla would fail”. Tesla’s Elon Musk replied, “I agreed with all his points…but said it was still worth trying anyway”.

“Can do” and “gotta try” attitudes are a driving force behind the U.S. economy’s dynamism. Everyday millions of minds are hard at it trying to make life better for others, their families, and themselves by crafting solutions to life’s problems.

"One thing I love about consumers is that they are divinely discontent. Their expectations are never static—they go up. It’s human nature. We didn’t ascend from our hunter-gatherer days by being satisfied. People have a voracious appetite for a better way, and yesterday’s ‘wow’ quickly becomes today’s ‘ordinary’. I see the cycle of improvement happening at a faster rate than ever before…you cannot rest on your laurels in this world. Customers won’t have it."

Amazon’s Jeff Bezos

The U.S. remains at the forefront of human ingenuity and innovation. Unlike most anywhere else, the U.S. is (mostly) tolerant of the creative-disruption dynamic. The U.S. is also more open to commercial experimentation and creativity, the diversity of ideas that help fuel innovation, and competition.

The payback has been a significantly more rapid improvement in the overall U.S. standard of living…and renewal and recovery from recessions and dark clouds.

For example, where would we be without MRNA vaccines?

Or where would the world (and energy prices) be without an intrepid band of frackers a few years back applying new technologies to harvest shale oil?

Whatever opinion one holds about fracking, it has allowed the U.S. to become one of the world’s largest energy producers. While many U.S. presidents promised (and failed) to make us “energy independent”, it was the frackers that pulled it off. U.S. energy exports, in fact, are preventing Europe from being totally beholden to dictator Putin and Russia’s oil and natural gas.

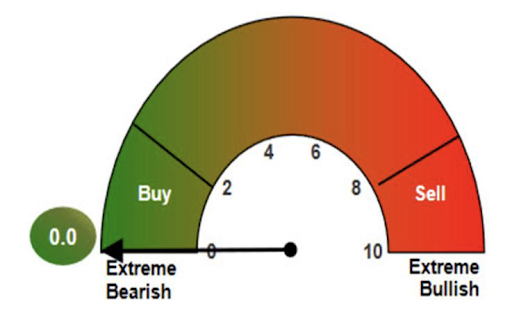

The over-the-top intensity in FUD about the present dark clouds in the economy suggests that many are underestimating the significant dynamism that exists within today’s economy. (See Chart 1)

Bank of America/Merrill Lynch

“Bull and Bear” Indicator (late June 2022)

Dynamism is being provided by the dissemination of Cloud computing, 5G, the “Internet of Things” and connected devices, artificial intelligence, advances in materials science, distributed and ubiquitous computing, to name just the top-of-the-mind developments underway. All are increasingly becoming part of the new toolkits business enterprises can use to address current problems.

They are helping power advances in genomics, biotechnology, and synthetic biology. Taken as a whole, the new tools being applied in these areas have the potential to revolutionize medical care.

"When something is important enough, you do it even if the odds are not in your favor."

Elon Musk

They are also instrumental in driving breakthroughs in areas like nuclear fusion, geothermal energy at scale and reusable rockets. These conceptions appear to be moving closer to becoming commercially viable innovations with “game changers” potential.2

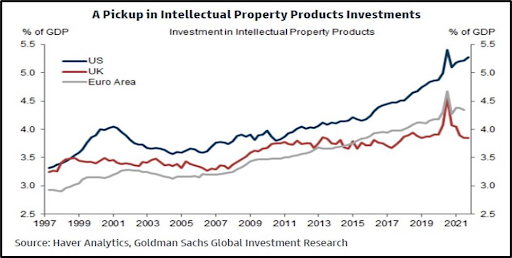

Additional evidence of increased economic dynamism—entrepreneurship and patents—also “bode well for future technology driven productivity growth” according to Goldman Sachs (see Chart 2).

Most of this promising “news” is being relegated deep into the investment background by the tunnel-vision focus of many on the current dark clouds. We think it is very likely to prove to be a big mistake.

Yes, the economy has issues…yes, that’s concerning…yes, politicians and policymakers seem out of touch with reality across the world…but the U.S. economy is building itself back better.

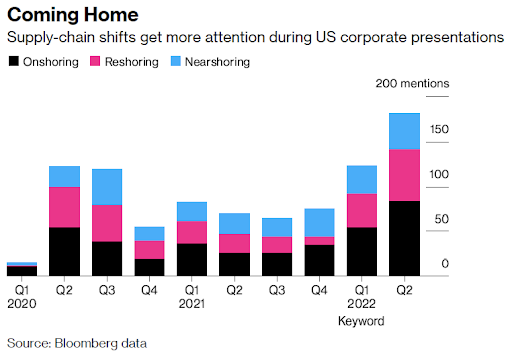

Supply chains are being rebuilt in ways that will be make them much more resilient. (See Chart 3 below). And, innovative digital tools are key ingredients within the rebuild process.

Regarding the dark clouds, leading indicators of inflation (declining commodity prices, on-line shopping prices, rapidly slowing money “supply” measures) suggest it may soon come off boil. Supply chain snarls have created worries that retailers wouldn’t have sufficient inventories. Now the concern is that many retailers have excessive inventories. The auto production capabilities across the globe were in a secular over-supply situation before the pandemic. Auto manufacturers will get back to producing all the vehicles people need.

The Fed may well end its tightening campaign—and perhaps even reverse course—much sooner than they themselves currently anticipate. That would significantly help in calming financial markets.

While no one knows what twists and turns lie ahead, we believe U.S. economic dynamism will once again play a key role in alleviating current economic troubles. As prior episodes, reflected in Bespoke’s table presented earlier, demonstrated intense FUD in the financial markets could quickly dissipate.

Maintain a dispassionate mindset towards markets

✓ “The stock market is a wonderfully efficient mechanism for transferring money from the impatient to the patient.”

✓ “Disregard mob fears or enthusiasms.” As these Buffett quotes suggest, emotions are typically the archenemy of investors.

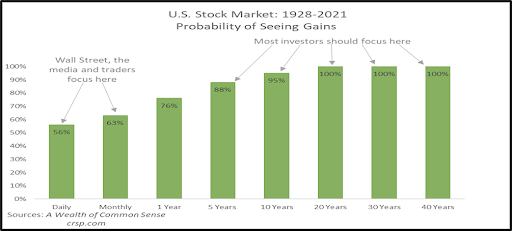

Behaviors—like focusing short-term (Chart 4) and overdosing on business media can also stoke emotions that are unhelpful for investors.

Regarding the media, we suspect the GOATs would agree with the following observations from two other investors:

“The environment in the investing profession is poisoned by stock market and the business news. Serious business news that lacked sensationalism, and thus ratings, has been replaced by a new genre: Business entertainment. (Of course, investors did not get the memo).” —Vitaliy Katsenelson

“In a world where communication through television and the Internet is omnipresent and virtually instantaneous, enormous intemperance occurs faster and more frequently than ever before.” —Barton Biggs

Maintain a longer-term perspective and focus on business fundamentals…invest in exceptional companies

✓ “Time is the friend of the wonderful business, and the enemy of the mediocre.” —Buffett

✓ “It is far better to buy a wonderful company at a fair price than a fair price company at a wonderful price.” —Buffett

Buffett’s mentor, Ben Graham noted: “in the short run the stock market is like a voting machine, in the longer run it is like a weighing machine.”

The research firm Morningstar provides a cogent explanation of Graham’s points:

“In the short-run, the stock market is like a voting machine—tallying up which firms are popular and unpopular. But in the longer-run, the market is like a weighing machine—assessing the substance of a company. The message is clear: What matters in the longer-run is a company’s actual underlying business performance and not the investing public’s opinion about its short-run prospects which can be fickle.”3

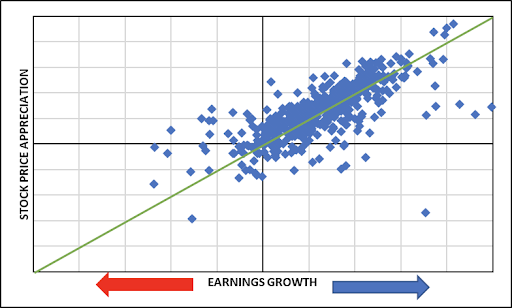

The sustainable earnings power of a business is what ultimately determines its stock price.

As noted on Chart 5 on the prior page, over time, the stock market is incredible at aligning stock returns with the underlying earnings progress of businesses.

Each blue diamond in Chart 5 represents the annual rate of earnings growth and stock price return in the U.S. stock market over the past 25 years.

Over time, exceptional companies that generate and sustain superior “fundamentals” (earnings power) become compounding machines for investor returns.

The GOATs’ exceptional investment returns were driven by investing in exceptional businesses over the decades.

Investment evolution of the GOATs

Buffett didn’t always focus his investment attention on exceptional businesses. He has evolved significantly as an investor.

We noted a moment ago that his early mentor was Ben Graham. Graham helped turn investing into a profession by developing security analysis. (Many of us “cut our investing eyeteeth” by absorbing the many editions of the popular book, Security Analysis).4

As an investor, Graham was a product of the Great Depression. During that period, it became possible to uncover stock prices trading significantly below companies’ net worth. “Is American Business Worth More Dead Than Alive?” was the title of a Forbes magazine series he wrote in 1932.5

In his early investment years, Buffett followed Graham’s approach which Buffet called “cigar butt investing.” The idea is if an investor can find a stock that has been tossed to the curb like an old cigar, the cigar butt may be unappealing, but its bargain price means that the few remaining puffs may result in investing profits.

Buffett’s approach changed once he met Munger. Munger was an “invest in exceptional companies” adherent. The duo became the GOAT investors as Buffett and Munger practiced the exceptional-stock investing approach.

Buffett’s quote, “It is far better to buy a wonderful company at a fair price than a fair price company at a wonderful price” reflects the change in Buffett’s approach as an investor. His investment process shifted focus from a stock’s price to the business underlying the stock.

It’s also interesting that before his death in 1976, Graham had an investment epiphany.6 He noted that a single investment he made in what proved to be an exceptional company (GEICO—which Buffett/Munger’s Berkshire acquired entirely in 1996) generated more profit than all of his other (cigar butt) investments combined.7

With all this being said, why doesn’t every investor go all in on Buffett and Munger and Berkshire Hathaway stock?

Buffett and Munger are both in their 90s, so they—to paraphrase Robert Frost—”may not have many more miles to go before they sleep”.

In addition, exceptional companies also change over time as creative disruption does its thing reshaping the economic and business landscape.

We—very humbly—submit that creative disruption is threatening to eat away at the compounding-machine-abilities of many of the cornerstones of the Berkshire’s holdings.

“Only when the tide goes out do you discover who’s been swimming naked.”

Currently, the dark clouds filling the skies are creating a period where the economic tide has crested and is perhaps now “going out”. The U.S. may already be in what will ultimately be designated as a recession.

But even if that doesn’t come to pass for the U.S., the environment has moved from a period where earnings growth was “plentiful like apples at harvest time” to a period where earning growth is like more “diamonds—hard to find”.

Let’s explain what we mean by this.

The longer-run earnings annual growth rate for U.S. companies is around 7%. The 2020 pandemic shutdown decimated the earnings of many companies.

General corporate earnings staged a huge recovery since 2020. Against the 40%+ earnings rebound registered last year for the S&P 500, earnings growth for exceptional companies have looked pretty ordinary.

Wall Street’s voting machine has cast to the curb nearly all companies (including those we own) that are at the forefront of driving creative disruption and driving the economy’s underlying longer-run growth trends.

As noted earlier, we believe this is a mistake and the “babies have been thrown out with the bathwater”.

"I did just a few things right. I bought a batch of great companies—and then I waited."

Warren Buffett

We own exceptional businesses.

Many have profit margins that are 3-to-4 times higher than the average U.S. company. Most are light on tangible assets and heavy on intellectual property.

The essential nature of many of their goods and products has created durable moats around their businesses as their offerings have become “woven into the fabric of daily life around the world, and every year the weave gets tighter and stronger” to quote investor Adam Seessel.8

Their higher profitability and earnings power enables them to have exceptional balance sheet strength and financial flexibility. Seessel sums it up well: “Higher profitability + lower tangible asset intensity = the highest returns on capital businesses have ever seen”.

The companies we own have been chosen based upon the both the superiority and durability of their earnings growth prospects. Most have highly recurring revenues with products and services that are essential infrastructure that enable an increasing number of companies to operate.

Should inflation remain higher for longer, businesses around the world will face increasingly intense pressures to be more efficient in battling increased costs. Adopting productivity enhancing infrastructure tools becomes a key way for other enterprises to offset rising costs.

The rate of change in the earnings growth of some of our stock holdings may slow in the short run if the tide’s truly going out. But we believe the earnings of our portfolios of businesses will grow at rates well above both that of most other firms and the rate of inflation.

Let’s end this missive where we began. None of us may be able to “Be Like Mike” on the basketball court. But we can be sufficiently like the investment GOATs to put the probability of investment success in the investors’ favor. Exceptional opportunity in exceptional businesses is being created. Hang in there, it will be worth it!

APPENDIX: What’s a reasonable valuation for an exceptional company?

Buffett’s early mentor Ben Graham is regarded as the high priest of stock valuation.

Buried within one of the editions of his Security Analysis is his take on an “appropriate valuation” framework for the stocks of exceptional companies.9

Although he doesn’t reveal how he came up with specific numbers in his framework, here it is:

8.5 + (2x a company’s earnings growth rate) = “appropriate” valuation (price/earnings ratio or “P/E”) of a stock.

Graham’s framework suggests that the higher the earnings growth trend, the higher is the justifiable P/E. In other words, exceptional companies should trade at a premium to average companies just as the price of a luxury car is higher than that of an “average” car.

Graham’s valuation suggests exceptional businesses should trade at P/E valuation premium of 1.5x (or higher) than that of the stock market’s P/E.

Presently, the combined P/E’s of our holding are well below Graham’s premium valuation framework. Our stocks may not be priced like cigar butts, but they are trading at unusually attractive valuations!

Sources & Notes

12020 Annual Meeting of Berkshire Hathaway

2Jim Pethokoukis’ blog Faster Please, tracks developments in these and related innovation efforts.

3Morningstar, The Purpose of a Company: The voting and weighing machines

4Benjamin Graham and Davis Dodd, Security Analysis, multiple editions since first published in 1934, various publishers

5Adam Seessel, Where the Money Is: Value Investing in the Digital Age, Simon & Schuster, 2022

6Benjamin Graham and Jason Zweig, The Intelligent Investor, (1973 edition), Harper and Brothers

7Seessel’s book as well as Fred Martin’s, Benjamin Graham and the Power of Growth Stocks: Lost Growth Stock Strategies from the Father of Value Investing document Graham’s investing career.

8Adam Seessel, Where the Money Is: Value Investing in the Digital Age, Simon & Schuster, 2022

9This topic is discussed at length in Fred Martin’s book, Benjamin Graham and the Power of Growth Stocks: Lost Growth Stock Strategies from the Father of Value Investing