“In a normal functioning market (company specific), fundamentals play a large role in the direction of individual stock prices. There are certain times, like now though, where the seas get rough, and Captain Macro takes the helm relegating fundamentals to steerage.”

The quote above is from a recent report by the investment research firm, Bespoke Investment Group.

Steerage, by the way, refers to the spaces below a ship’s deck where the poorest immigrant passengers traveled during the era of long-distance steamer voyages. (We suspect many of us may have had ancestors that traveled to this country in steerage!)

Cartoon: Growth is increasingly like diamonds—hard to find

Macro is a reference to macroeconomics—a big picture view of the economy.

The current macro situation is aptly captured by the following excerpt from The Economist magazine:1

“The extraordinary challenge of the pandemic led to extraordinary actions which helped unleash today’s inflation: wild government stimulus, temporary skewed patterns of consumer demand and lockdown-induced supply chain tangles. That inflationary impulse has since been turbocharged by the (food and) energy crunch (associated with Russia’s tragic invasion of Ukraine)”.

Bespoke’s Captain Macro is essentially about two macro factors—the COVID lockdown-induced inflation and the inflation fighting policies of the U.S. Federal Reserve (Fed) and their central bank counterparts around the world.

Yes, the financial markets are keeping a wary eye on geopolitical developments—as they should. But what’s really moved markets this year has been the central banks and their battle against inflation.

And the lens through which Captain Macro is viewing things has a thick coat of gloom and doom. Good news of just about any sort is quickly dismissed and bad news is amplified.

Consider:

- For years some policy makers bemoaned the slow growth in many wages were rising more slowly than those of higher earners. Now that they are rising more quickly—especially at lower income levels, this development is ‘bad news’ because it’s inflationary.

- Low unemployment is similarly ‘bad’ because it too is viewed by Captain Macro as inflationary. Ditto for most any macro indicator that is suggestive of positive economic growth.

- A significant breakthrough in disease management occurred this year. DeepMind, a division of Alphabet (Google), figured out a way to solve the so-called protein folding problem that has perplexed scientists for years.

The breakthrough can ‘predict the shape of proteins in a human body, at scale and in minutes down to atomic accuracy’.2 It’s a potential game changer for medical research and novel treatment strategies.

What does Captain Macro think of this innovation? Doesn’t care a whit because ‘the Fed’s going to raise rates’.

“The worst of COVID may be behind us, but the economic challenges we face are no less daunting.”

Jane Fraser, CEO of Citigroup

Nowhere to hide: bond and stock prices have declined at the same time

Bonds:

The Fed has lifted policy interest rates at the fastest pace in nearly 40 years to address the COVID shutdowns induced inflation.

The way ‘bond math’ works, rising interest rates and rising bond yields drive a decline in bond prices. Since bond yields began the year at extremely low levels, the rapid rise in yields has caused the bond market to suffer one of its worst periods on record.

Through the end of September, the popular bond market benchmarks have experienced bond price declines of -15%, investment-grade corporate ETFs are down -20% or more, and long-term U.S. Treasury prices down -30%. Even Treasury Inflation Protected Securities (TIPS) have succumbed to the rapid rise in ‘real’ interest rates. The TIP ETF, for instance, is down -13% on a year-to-date basis.

Typically, bonds have provided some cushioning within portfolios when stock prices are under duress. Not this year…as rapidly rising bond yields have negatively impacted bonds and stocks at the same time.

Our bond investments:

Before we proceed, we want to remind readers of what we believe is a very important point. When we say “our” bonds or “our” stocks, it’s because each of us here at Capital Investment Services and many of our families are also clients of our firm. As a result, we own the same stocks and bonds as all our clients do.

We believe responsible investment stewardship requires us to ‘eat our own investment cooking’ and participate alongside clients during rewarding markets as well as markets (like now) that are full of mayhem.

Our conservatively postured bond investments have fared much better than most of the bond market. But they have not escaped unscathed either.

However, it’s important to note that with yields now having risen to their highest levels in nearly 15 years, the risk/reward profile has significantly improved for the higher-quality, shorter-term bonds we favor.

Our bonds should again become both a rewarding and stabilizing influence within portfolios.

Stocks:

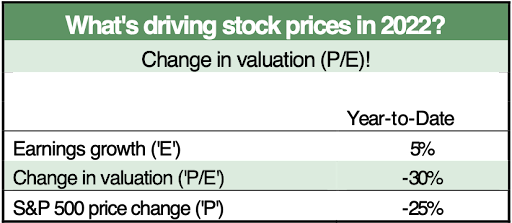

Bespoke’s steerage comment we began with noted that company fundamentals are being overwhelmed by Captain Macro. The table on the next page supports Bespoke’s view.

Among the most important stock investing ‘fundamentals’ is the earnings power of the underlying business. A stock price is ultimately driven by the earnings power of its business. Not with Captain Macro at the helm.

Table: Lots of bad stuff expected—and reflected—in stock prices

As this table reflects, the entire decline in stock prices in 2022 to date is due to a material erosion in stocks’ valuation (lower P/E or Price-to-Earnings ratios.) Higher interest rates have weighed on valuations, but gloomy expectations and investor emotions have played a big part as well.

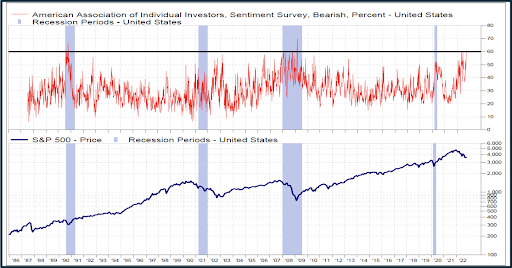

Chart 1 (on the next page) provides some historical context to just how pervasive the negative sentiment is among investors3 towards the stock market.

The top panel reflects the percentage of investors surveyed that are negative (‘bears’) on the stock market. Bearish stock market sentiment has risen to the rarefied air of multi-decade extreme levels.

But it’s also important to note that such extreme negative sentiment levels have repeatedly corresponded with critical turning point ‘lows’ in the stock market as the bottom panel in Chart 1 reflects.

Chart 1: Investor sentiment at negative extremes

Emotions typically run the hottest at market extremes. Numerous studies over the years have shown that investors suffer significant lasting financial damage by making emotional investment decisions and bailing out of markets near extremes.4

"Proper investment strategy is as much of a psychological as an intellectual challenge."

Wharton Professor Jeremy Siegel

Our stock investments:

We own a portfolio of exceptional businesses with exceptional fundamentals. Our stock investments are characterized by businesses that possess superior secular earnings growth prospects, high recurring revenues, generate abundant cash flow, most are asset light with low levels of operating leverage and cyclicality, and they have strong balance sheets and possess a great deal of financial flexibility.

Fundamentals may not matter right now with Captain Macro at the Helm of market movements.

We believe, however, that fundamentals matter, and they matter a great deal. In the near future, we expect the market will return its focus on fundamentals.

Here’s why.

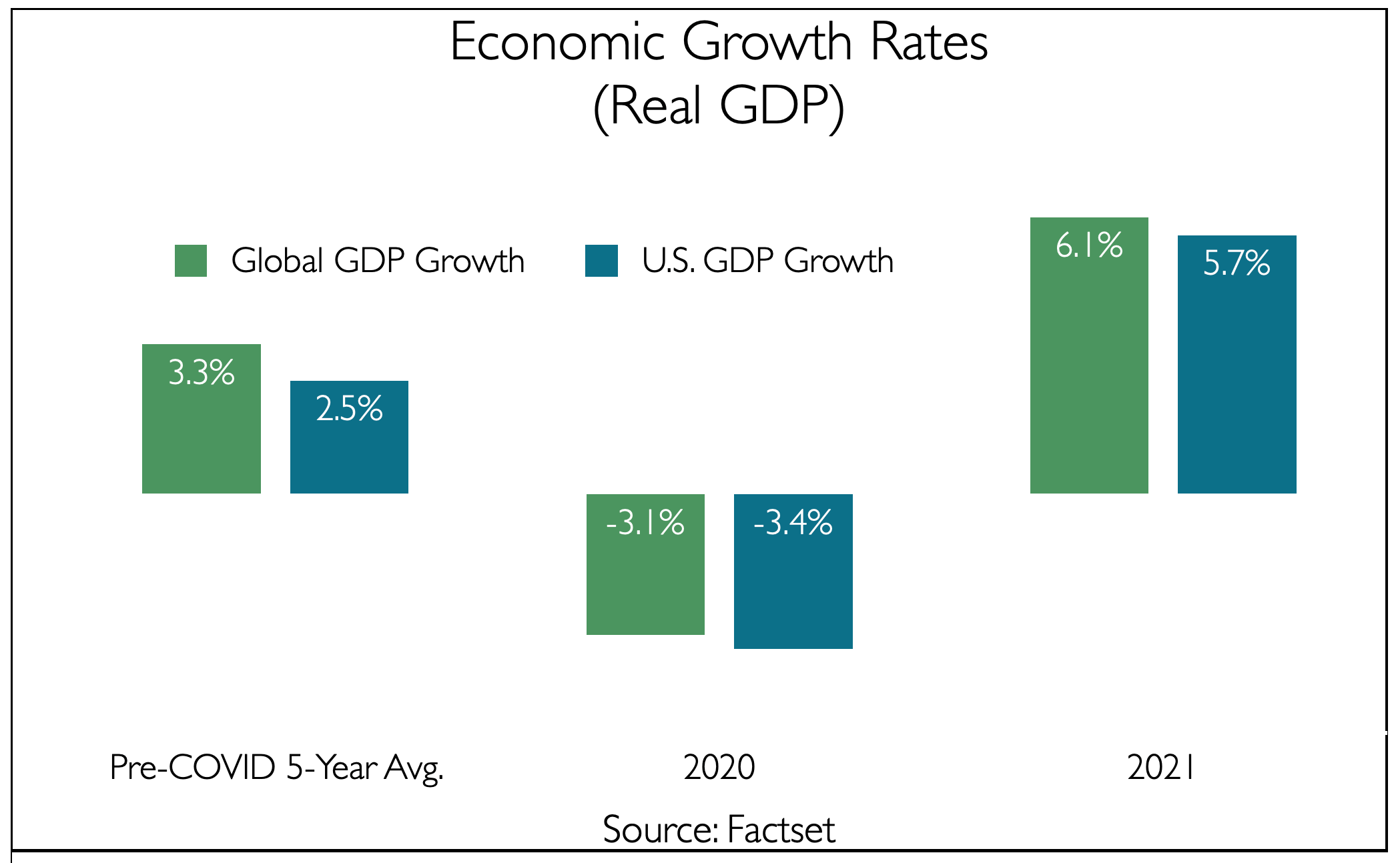

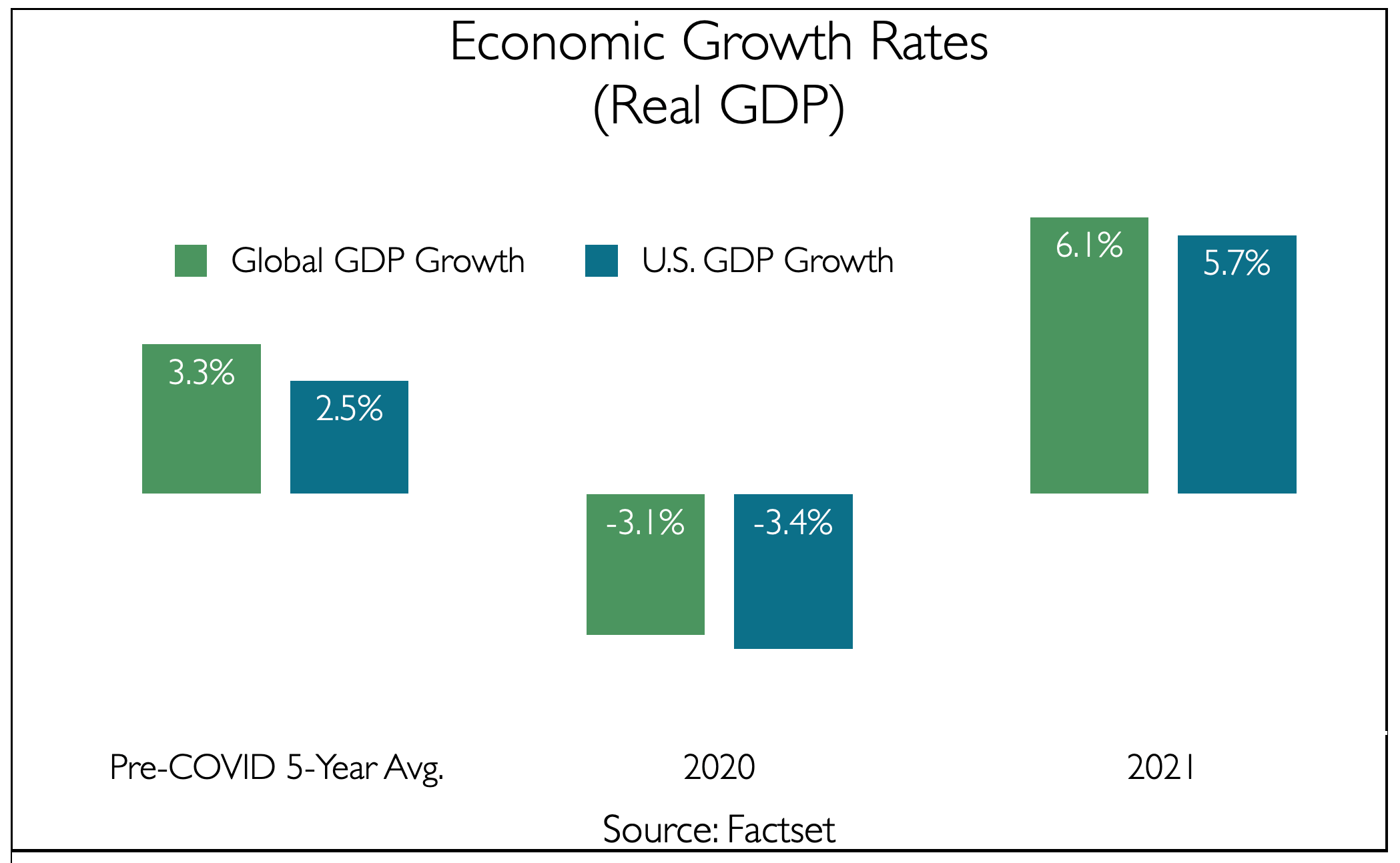

The ‘extraordinary actions’ in response to COVID shutdowns in the economy created something resembling a ‘sugar high’ in the economy (Chart 2) and corporate earnings growth (Chart 3).

Chart 2: The pace of real (inflation adjusted) economic growth was destined to slow from 2021’s ‘sugar high’ towards pre-pandemic growth trend—even if the Fed had not lifted interest rates…

Chart 3: Like economic growth, general corporate earnings growth was destined to slow down from 2021’s ‘sugar high’

Regarding earnings growth, in a prior Perspective, we characterized last year’s elevated +35% growth in general corporate earnings growth as indicative of earnings being as abundant as ‘apples in harvest time’.

General earnings growth was destined to slow towards its longer-term underlying trend around 7%.

Now, with the Fed making sure COVID-induced inflation remains just a sugar high and does not become sown into the economic fabric as it was in the 1970s, strong earnings growth is going to be even more like ‘diamonds’—hard to find.

Stocks of businesses that display exceptional fundamentals by delivering durable, profitable growth will—like diamonds—become more valuable and sought out by investors.

The innovation driven-growth trend that characterized the pre-and early COVID periods may be relegated to steerage right now, but the trend is far from over.

We believe it will re-take the helm from Captain Macro on any indications that the Fed is nearing the end of its rate-hiking campaign.

As we discussed many times on prior occasions, the secret sauce underlying the U.S. economy is its ability to commercialize innovation. Innovation is what enables improvements in the overall standard of living.

Many of the challenges facing businesses—tight labor markets, the need to operate more efficiently, doing more with less, reworking and improving supply chains—can be addressed with new productivity tools being developed at many of our portfolio companies.

"What I did was buy some good companies over time - and then I waited."

Warren Buffett

Like those poor immigrants that came to this country in steerage, exceptional businesses find ways to adapt to the environment—2% inflation, 6% inflation, 8% inflation, different administrations in the White House, etc.

Fundamentals will matter again.

Inflation problem is in the process of unwinding

Earlier, we included a short excerpt from The Economist Magazine describing the present macro backdrop. The Economist identified two key elements that have powered the pandemic-shutdown-induced inflation that the Fed is attacking:

✓ Government stimulus

✓ Supply chain tangles

Multiple rounds of stimulus checks helped pump up spending. Meanwhile the supply side of the world economy remained compromised due to shutdowns. The combination created a “too much money chasing too few goods and services” situation. The result was higher inflation.

Significant changes are afoot in both “too much money” and the “too few goods” aspects of the COVID shutdown induced inflation.

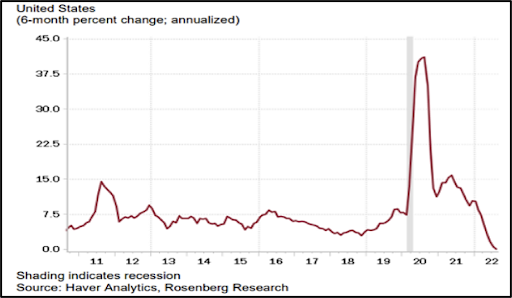

Chart 4 provides insight into money supply growth. As the earlier repeated rounds of government stimulus checks were cashed, they helped power the surge in the money supply.

Chart 4: Money supply (M2 measure) surged in U.S. pandemic shutdown, now its rate of growth has sharply slowed

But notice what’s happened since…the growth in the money supply is running at a pace below pre-COVID trends. The fuel for sustained inflation from this source is significantly being diminished.

Economist Scott Grannis comments about this situation are worth considering:6

“The current episode of Fed tightening that we are living through is fundamentally different from all the others. Why? Because the excess money creation that fueled the surge in inflation over the past year was a one-off event that was tied directly to the trillions of dollars of fiscal stimulus that politicians pumped into the economy in the wake of the Covid lockdowns.”

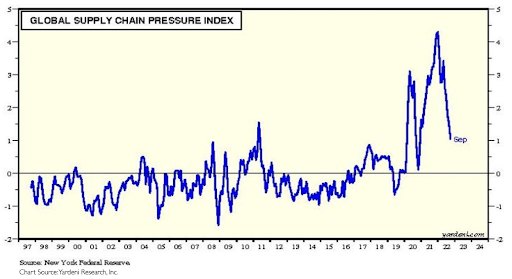

Meanwhile, the conditions that drove the “too few goods” part of the pandemic induced inflation are registering significant improvement (Chart 5).

Chart 5: Supply chain restraints are easing

Supply chains are being reworked and becoming untangled. Global shipping costs have collapsed. Cargo ship traffic jams at ports have vanished. The prices of most commodities have significantly declined from their peaks. Retailers’ inventories have gone from shortages to gluts with price cuts coming for the Holiday Season.

What about autos and light trucks, where prices surged, and backlogs have persisted?

Used vehicle prices have begun to decline. One auto analyst believes that within the next three to six months the new vehicle market will experience a “paradigm shift from under to oversupply”. As this unfolds, he expects most vehicle suppliers will lose the pricing power they gained during the pandemic.7

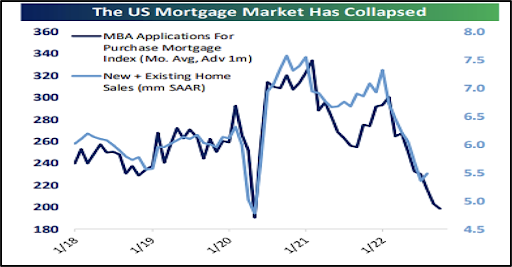

Another source of inflationary concerns has been home prices.

As Chart 6 indicates, the dynamics underlying housing activity has abruptly gone from ‘hot’ to ‘cold’ as mortgage rates have surged (lumber prices are down nearly -70% from their peak, by the way). Home prices have, and likely will continue, to cool off.

Chart 6: From feast to famine

For inflation to persist at current rates, the ability to constantly raise prices must exist. During the great inflation of the late 1960s through early 1980s, conditions enabled relentless price increases year after year for the better part of 17 years. Back then (for reasons we review in the Appendix) there was a persistent condition of both strong demand and strained supply.

The COVID-induced elevated inflation is now about 17 months old. The conditions that have powered it — ”too much money” and “too few goods”— are significantly changing as we documented earlier. And these changes strongly suggest the COVID inflation is in the process of unwinding.

The diminishing inflationary pressures will likely soon be reflected in the popular inflation measures that the Fed apparently is focused upon (Consumer Price Index, Producer Price Index, Personal Consumption Expenditure).

When they do, Captain Macro will no longer be at the helm…

And that may even happen sooner

It’s important to recognize that the Fed’s macro-forecasting record isn’t great. Pre-pandemic they consistently over estimated economic growth and inflation. They came into 2022 expecting 4% economic growth which looks increasingly like a pipe dream.

We’re not picking on the Fed, macro forecasting is a low probability endeavor. The promise of macro is that the old saying, “can’t see the forest through the trees,” can be overcome by viewing the economic world from a top-down perspective.

The problem is, with a top-down view, one may be able to see the forest, but not the individual trees. And in the real economy, the ‘trees’— consumers, businesses, governments—are constantly moving and often in unpredictable ways due to emotions, desires, and changing incentives.

The pandemic shutdowns and policy responses were an epic shock to economies, with few historical parallels.

As a result, things can change in a hurry.

Investors should be grateful, by the way, that the Fed can fight inflation. In some countries (including our own as recently as the 1970s), the central bank does what politicians command them to do.

But the Fed doesn’t operate in a vacuum. One of the by-products of their tightening campaign is a surge in the value of the dollar relative to other currencies. That the dollar is surging implies that the U.S. economy is in fundamentally good shape, particularly relative to other economies.

But the dollar surge does increase the strain on the many countries that have dollar denominated loans, or that purchase oil (which typically is denominated in dollars).

And while our Fed took rates to historic low levels to fight pandemic shutdowns, many of their counterparts around the world took interest rates to negative levels. Seeking some yield on their investments, Pension funds in the U.K. apparently turned to exotic investment products that are highly leveraged.

Now that the Fed’s leading the charge to higher rates, some U.K. pension funds are receiving the equivalent of margin calls on these leveraged products. This has triggered forced selling of bonds in the U.K. and is adding upward pressure on bond yields across the world—including U.S. yields.

In 1990 the Fed backed off from rate hikes that contributed to a debt crisis in Mexico. More recently, the Fed also backed off a rate hike campaign in late 2018 when collateral markets here began to show signs of stress. In both instances, stock and bond prices surged as the Fed changed course.

It’s conceivable the Fed could yet again change course much sooner than currently believed.

Considerable mayhem exists indeed…but it will be worth it to hang in there!

APPENDIX: This is not the 1970s

Here are the fundamentals today versus those of the 1970s:

Current demographics are very different. The massive Baby boomer population wave came of age in the late 1960s and throughout 1970s. As this unfolded, two income households became widespread and helped power consumer demand. The economy’s productive capacity was constantly strained to keep up with demand even as interest rates rose (some of us had home mortgages with rates well into the teens).

Today, the next generations of Americans only modestly outnumber the baby boomers. Until the pandemic shutdowns, the supply side of the economy was not under persistent strain.

Meanwhile, the 1970’s money supply regularly grew rapidly for years, as the Fed tried to compensate for OPEC’s increasing oil prices nearly 12-fold during that period. Meanwhile, former President Nixon exerted significant pressure on the Fed back then to keep the monetary juice flowing.

As we discussed earlier (pages 8-9), the present situation is much different.

And while the world is presently grappling with high oil prices, from pre-pandemic levels (roughly $60/barrel of oil), prices would have to reach roughly $700 per barrel to approach the OPEC price hike shocks of the 1970s.

In the early 1970s, the U.S. also abandoned the last vestiges of the gold standard by no longer allowing other central banks to redeem dollars for gold. This called into question our resolve to fight inflation.

The trade value of the dollar was under persistent downward pressure during the 1970s. Today, the opposite is happening as the dollar has surged.

Sources & Notes

1 A New Macroeconomic Era is Emerging, The Economist, October 6, 2022

2 deepmind.com/research/alphafold

3 Shown is survey canvassing individual investors. Survey of professional investors (Institutional Investors Survey) reflect similar results.

4 See for example “Quantitative Analysis of Investor Behavior 2022” by Dalbar, Inc. (dalbar.com). Also, we document the finding of several other studies of the returns sacrificed to emotional investment decisions within the document, “The Difference Maker: A Profession of Investment Stewardship,” available at capinv.com

5 ‘Harvest time’, Perspective, March 31, 2021

6 Scottgrannis.blogspot.com

7 “Ford, GM downgraded by UBS analyst Patrick Hummel”, cnbc.com, October 10, 2022