More than a decade ago, as part of our research process, a couple of us flew to Washington D.C. and met with the CEO and CFO of a company we were evaluating. Even before the visit, we knew that the company provided a lot of information about how the business was performing, more details than the average company shared at the time.

In fact, we believed the volume and frequency of data they disclosed was causing some analysts who followed the company to focus on short-term results. We asked them why they chose to give so much insight or “visibility” into the business.

The CEO smiled and answered, “Well, the flip side of visibility is visibility, isn’t it?”1

In other words, the advantage of being as transparent about the business as possible so folks could understand what management was doing and why they were doing it, could also prove to be a disadvantage if some disclosed metrics stalled over the short term.

This could lead investors and folks following the company to jump to hasty conclusions about the stability of the business causing more instability in its stock price than warranted. Visibility, it seems, could not only be a virtue, but also a vulnerability.

There is another term for the unintended consequences of this kind of visibility; we call it noise, and we think trying to cancel it helps us keep focused on fundamental drivers of economies and markets.

Information Proliferation

Information Proliferation

Much of the developed world is awash in data, both its collection and its dissemination. Google alone is thought to process over 3.5 billion searches per day.2 It’s not just the information itself that creates the potential for noise, it’s also the way it’s presented.

In the months leading up to the 2020 elections last November, we were bombarded with noise in the form of data analysis, polls, projections, and pontifications from all sides intended to give us real visibility into the political leanings of the country. Afterward, we are left to consider the following:

Statement 1: In the November 2020 elections, the Democratic candidate beat the Republican candidate for President.

Statement 2: In the November 2020 elections, the Republican candidate received more votes for President than any other candidate in American history, except for the Democratic candidate.

Both statements are true. “Framed” differently, however, they can elicit opposing perspectives of looking at the same outcome.

Statement 1 might suggest that with a Democrat as the victor, increased regulation and government spending – which we contend are policies that can act like a “wet blanket” dampening growth – are higher probability events.

Statement 2 might lead one to conclude such policies are either lower probability events or at least, perhaps not likely to be as impactful as feared.

How should we think about sorting through some of the very visible and audible noise in the investment landscape?

Active Noise Cancellation (ANC)

Just like the headphones many of us wear on airplanes that drown out most of the steady, dull noise of the airplane, we think it’s vitally important for our investment perspective to strive for active noise cancellation (or ANC as audiophiles might refer to it). We’re trying to offset the flipside of visibility and keep attention focused on the bigger drivers shaping the investment landscape.

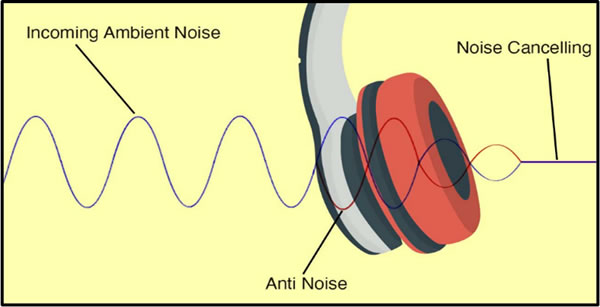

Ever wonder how noise cancelling headphones work? Simply put, sound occurs as a pressure wave or a disturbance in current. There’s the sound you intend to hear, such as music, and then there’s additional sound like noise from an engine or hiss from a radiator. Passive noise cancellation involves things like soundproof rooms and ear plugs. A headphone with active noise cancelling properties contains a microphone that produces an opposite disturbance effectively cancelling undesirable noise. It looks something like this:

The concept of ANC offers an investment perspective through which we metaphorically try to “listen” for the profound while cancelling the less consequential.

ANC and 3D: Demographics, Decline, and Demand

In previous Perspectives and other writings, we have explored the importance of three factors shaping global investment opportunities. The first is demographics, the second is the secular decline in interest rates, and a third could be characterized as a demand for “safe” assets.

Let’s try to listen for what these factors are telling us through our active noise cancelling headphones.

Demographics

| Noise | Active Noise Cancellation |

|---|---|

| Current and future demographic challenges will encumber U.S. growth | The demographic profile of the U.S. working-age population is stronger and is better-positioned to adapt than many other industrialized nations. |

“Demography is destiny,” French philosopher Auguste Compte is thought to have said. Baby booms, graying elders, education, migration, mortality, these are just some of the basic inputs influencing the direction and magnitude of a country’s economic growth. There has been a great deal of profound work done on this subject and its implications for American economic future.

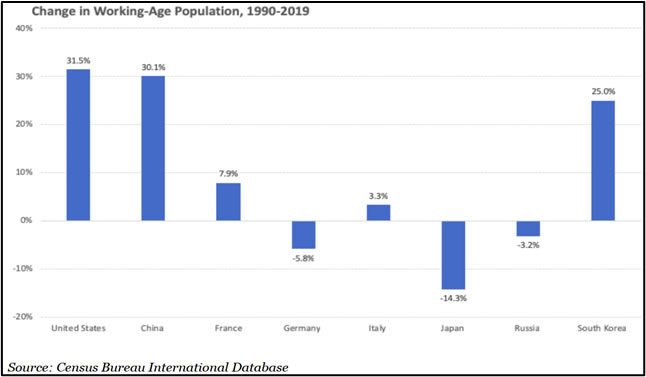

Some suggest that the U.S., owing to the strength and quality of its human capital (i.e., factors that unlock and ameliorate worker potential) combined with its relatively more favorable business climate, maintains a kind of “demographic exceptionalism”.3 Others suggest America has slowly lost its competitive advantage in this regard due to factors outside its control (dropping birth and fertility rates) and squandered opportunities within its control (restrictive immigration policies and rising levels of inequality). Take a look at the next two charts nearby through which Morgan Housel of The Collaborative Fund offers some big-time noise cancellation.4

The first chart shows the change in working age population among eight major industrialized nations over the last 30 years:

Clearly, former economic juggernauts like Japan and Germany have lagged in terms of growth of their workforce, and so have their economies and stock markets.

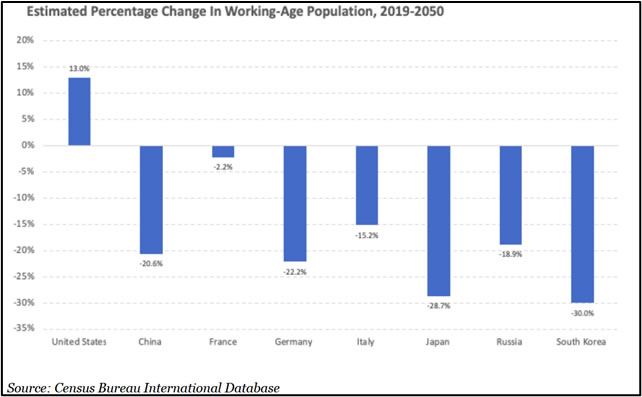

This second chart shows what’s expected to happen over the next 30 years:

Even if the magnitudes of differences are off, if the direction is in the ballpark, the implication is clear: all of these other industrialized nations will have to squeeze a heck of a lot more productivity from their working-age population to keep up with what the U.S. can potentially achieve through labor force growth alone.

Housel writes:

“People like to talk about new technologies and innovations, because that’s fun. Demographics aren’t fun. But they’re going to be as important, if not more, to overall economic growth than most innovations over the coming decades.”5

During the 1970s and ‘80s predominant thinking among spheres of influence admonished about increasingly limited resources and an apocalyptically overcrowded planet. But from the ‘90s onward, incredibly powerful and unanticipated productivity gains contributed to meaningful improvements – some measurable, others more intangible – to faster growth and higher standards of living. Access to higher education, the democratization of instant information, and the flight of labor from rural to urban areas have now shifted concerns of a population bomb to concerns about a population bust.

We suspect at least some chapters on all sides of the demographic narrative may need to be edited in a post-Pandemic world, but we think there is enough evidence to suggest that the U.S. still maintains a better probability to exceed its industrialized competitors in terms of growth.

Our intent is not to dismiss concerns about changing demographics and slowing population growth in the U.S. – far from it – but simply to cancel the noise that threats to America’s supremacy as a global driver of innovation and growth are inevitable or insurmountable. Demography may be an important part of our destiny, but it is also within our power to shape its trajectory and impact.

Interest Rates

| Noise | Active Noise Cancellation |

|---|---|

| The U.S. economy (and its stock prices) have been “propped up” by The Federal Reserve’s decades-long, “easy-money”, low-interest-rate policy. | Interest rates have been in secular decline on a global basis for decades. U.S. interest rate policy has played a supportive role but has not been the primary driver of stock prices over time. |

Some readers may recall the late 90s, when noise over interest rate policy centered around the size of then Federal Reserve Chairman Alan Greenspan’s briefcase. It’s true! The financial press gave so much attention to whether the briefcase was bulging with papers (evidence, they said, that Greenspan was going to present reams of data supporting an interest rate hike) that even some Federal Reserve members mentioned it in a research paper!6 Talk about the flip side of visibility!

Today, seemingly every time The Federal Reserve (The Fed) gears up for a meeting, so much noise surrounds the event, that the larger, more important implications of the secular trend in rates is ignored or forgotten.

Last March, while we were in the throes of historic stock market volatility, during an interview with former Federal Reserve Chairman Ben Bernanke, a CNBC anchor asked if he thought our current, prolonged period of “ultra-low” interest rates was a contributor to boom and bust economic cycles. Here’s his response:

“If you look for example at Japan, which has had zero interest rates for 30 years, I have not seen, you know, a whole lot of booms and busts in Japan. But I think it’s something you have to watch out for. The other thing I would say is low interest rates are not — I know some of you will be skeptical, it’s just a fact that low interest rates around the world are not primarily a monetary policy phenomenon. Interest rates around the world have been declining since the ’80s. If you look at the ten-year Treasury yields since 1980, from then until now, 40 years, it looks like a ski slope. The rate just keeps coming down and down and down. And as I’ve talked about before, I think what we have in the world is a global savings glut. There are longer life spans, rising incomes, and for a variety of reasons, there’s a lot of savings in the world. Any asset manager will tell you that. And it’s hard to find good uses for that money. Harder to find good capital projects. So, the — even when monetary policy is at a normal level, and we got pretty close to a normal level when the Fed was raising rates earlier, interest rates are going to be much lower than in the past. So, low interest rates are something we are going to have to live with for a while, very likely. And we have to be alert about financial risk. The Fed is looking at that in much more detail than we used to. But, again, it’s not a monetary policy thing. It’s a long-term trend.”7 (emphasis added)

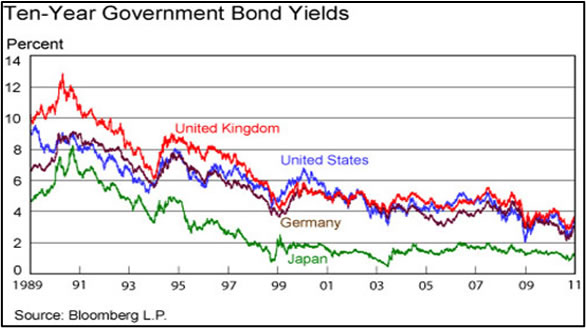

The chart below highlights the “ski slope” in 10-Year Treasury Bond Yields – including the 40-year period – that Chairman Bernanke referred to. The grey verticals are periods of recession (i.e., the “bust” in the “boom bust” cycle).

Source: https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

The chart on the following page highlights that the secular decline in rates is not just a U.S. phenomenon, but a global one too, as Chairman Bernanke pointed out.

Source:https://libertystreeteconomics.newyorkfed.org/2011/08/international-spillovers-on-government-bond-yields-are-we-all-in-the-same-boat.html

While it’s certainly true that this period of ultra-low interest rates has assisted an expanding U.S. economy which in turn has supported stock prices, we believe there is a lot of noise potentially attributing this correlation with causation.

Look at the countries in the European Union or Japan; even with the same secular decline in interest rates, their economies are barely growing, and their stock markets remain moribund, especially compared to ours. Why is this the case? The next area we examine may offer a reason.

Demand for “Safe” Assets

| Noise | Active Noise Cancellation |

|---|---|

| Demand for the relative safety of the U.S. compared to the rest of the world has driven American stock and bond prices higher. | Problem solving for customers, risk-taking experimentation, and investments at scale have driven faster, higher-quality growth in the U.S. relative to the rest of the world. |

It’s certainly true that the U.S. has been and continues to be considered a “safe haven” for assets in turbulent times. Our dollar is still considered the primary reserve currency of the world. Some economies boom and bust far quicker and more often than ours, while some governments scrap multibillion dollar IPOs at the 11th hour because they don’t tolerate criticism very well. So, the idea that U.S. markets are a safer place for investor capital is not noise; it’s fact.

But we would argue that the real reasons why we have attracted capital historically, why it accelerated through the Global Pandemic, and why we believe it will continue in whatever world exists after it, are not fully appreciated.

A professional who consults for several local-area McDonald’s franchisees recently shared an observation that many of them are reporting one of their most profitable years in memory. How is that possible in the midst of The Global Pandemic?

No doubt that part of the reason is the sharp contraction in other available options, but it’s also because McDonald’s business model is much more rapidly scalable than the industry in which it operates, better able to adapt and adjust to disruption. They quickly standardized the menu offering fewer items and less customization. Restrictions on indoor dining means floors and restrooms don’t have to be cleaned as often. For now, gone too are the free soda refills. But service is now faster, and orders are more accurate, so customer satisfaction is up. Company-wide, September was their best month for sales in almost a decade. This is problem solving for the customer, rapidly, and at scale.

Getting a Quarter Pounder faster (without forgetting the fries) is one thing. But it pales in comparison to the degree in which the country has learned to solve real and complex problems faster and through all the operational challenges wrought by the pandemic, including limited physical proximity.

We have written before about investment trends that were in place prior to the pandemic that have only accelerated through it. Each quarter of 2020 we listened as companies revealed new efforts to create more value with less of everything in areas like cloud computing, predictive analytics, internet of things, and digital finance.

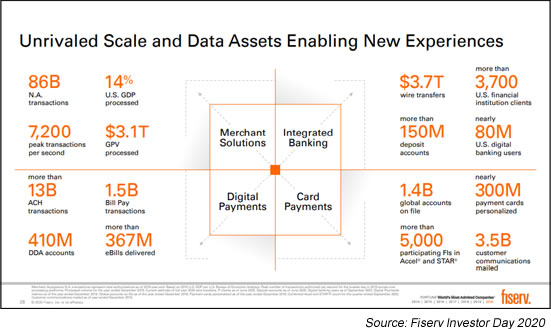

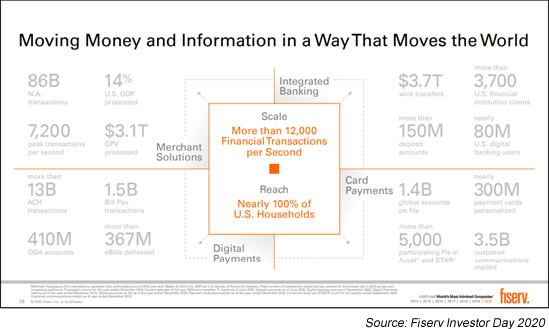

For example, owing both to restrictions on employees working at the U.S. Mint as well as a decline of hard currency being exchanged through day-to-day American commerce, the pandemic delivered us a “coin shortage”. Customers have adjusted, turning increasingly to digital and contactless payments. Companies like Fiserv, that have spent years inventing systems, accumulating data, and acquiring scalable properties are uniquely positioned to respond as the slides on the following page illustrate:

Experimentation, problem solving at scale, and a free, unencumbered system that encourages all of it to happen is what leads to superior innovation and growth. And it’s the track record of consistency and dependability of this process in the U.S. that is the safety investors prize.

Final Thoughts

Twenty years ago, this coming September, many of us stood in front of our television sets, mouths agape, watching as two of the most visible symbols of this country’s freedom and economic prowess were attacked and then collapsed before our eyes. But even before the shock of the attack wore off, the private and public sectors rolled up their sleeves and got to work. Barriers to collaboration and partnership were lifted, so that investment and experimentation in screening, biometric identification, and counterthreat measures could be scaled and fast-tracked. The result: foreign terrorist plots on our shores have been foiled and countless lives have been saved.

Nearly twenty years later, this era of big data and information proliferation afforded us incredible visibility into our preparedness for a global pandemic. The flip side of this visibility may expose many vulnerabilities, but through the noise we hear about problems being solved rapidly and at scale.

Take the development and rollout of a COVID-19 vaccine, for example. As Graham Allison, a professor of government at Harvard recently wrote in a Wall Street Journal Op-Ed:

“With the rollout of Covid-19 vaccines, a light has appeared in the darkness. A hard winter lies ahead, but this pandemic will soon be over. How can this be happening only 10 months after the first Covid death in the U.S., rather than the 10 years it took to develop a vaccine for measles?

There are clearly only two primary causes behind the Covid-19 vaccine. The first was the capitalist system, which facilitated competition between private, profit-seeking biotech and pharmaceutical companies to produce a lifesaving product . . . Second is Operation Warp Speed. Had [the President] not created the initiative, appointed as its leader a man who knows the vaccine development world, and given him license to spend $10 billion outside normal contracting procedures, Covid-19 vaccines would still be only works in progress . . .

So as Americans now look forward to getting vaccinated and resuming our normal lives, we should pause to give thanks to a remarkable group of scientists and entrepreneurs whose capitalism-fed competitive drive pushed them to venture into the unknown—for fortune and fame.8

French philosopher Blaise Pascal once said, “All of humanity’s problems stem from man’s inability to sit quietly in a room alone.” Maybe that’s true. But what we hear through our active noise cancelling perspective is that all of humanity’s problem solving also stem from man’s inability to sit quietly in a room alone.

Sources & Notes

1 Thomas Monahan, CEO, Corporate Executive Board, circa 2007. Metrics the Company disclosed back then – contract value growth, organic growth, and free cash flow growth have today become routine disclosures for many high-quality businesses.

2 https://www.forbes.com/sites/bernardmarr/2018/05/21/how-much-data-do-we-create-every-day-the-mind-blowing-stats-everyone-should-read/?sh=7fb1a60960ba

3 https://www.foreignaffairs.com/articles/world/2019-06-11/great-demographics-comes-great-power

4 https://www.collaborativefund.com/uploads/Three%20Big%20Things.pdf

5 https://www.collaborativefund.com/uploads/Three%20Big%20Things.pdf

6 https://www.stlouisfed.org/publications/regional-economist/july-2000/inside-the-briefcase-the-art-of-predicting-the-federal-reserve#endnotes

7 https://www.cnbc.com/2020/03/25/cnbc-transcript-former-fed-chairman-ben-bernanke-speaks-with-cnbcs-andrew-ross-sorkin-on-squawk-box-today.html

8 https://www.wsj.com/articles/who-made-the-vaccine-possible-not-who-11608744603Loonshots, Safi Bahcall, St. Martin’s Publishing Group, copyright 2019

Information Proliferation

Information Proliferation